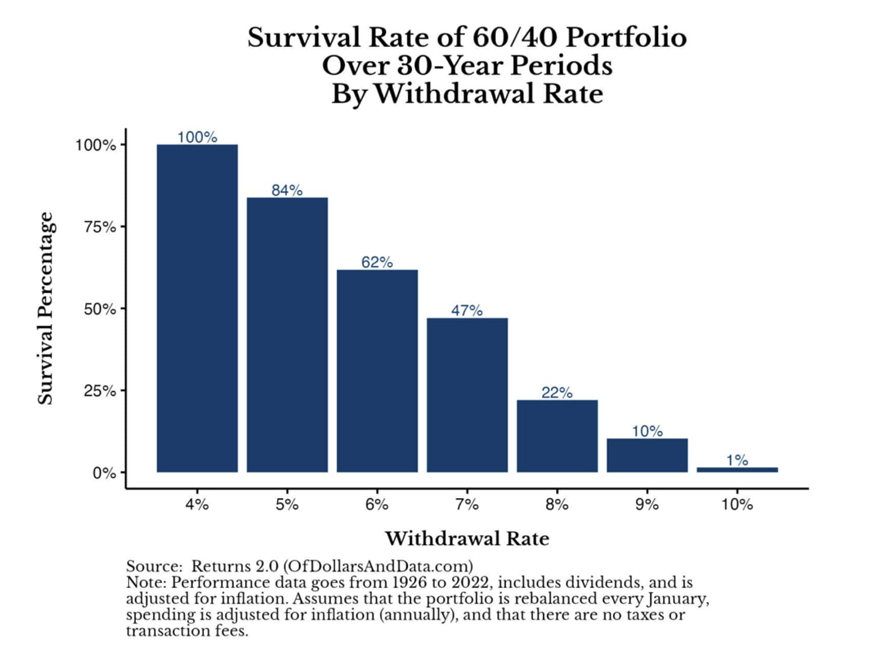

The 4% withdrawal rule is a bedrock principle of financial planning for a reason. The central idea is that when you have accumulated enough in assets to draw 4% a year, increased by 3% each year to cover inflation, you can retire. In other words, when you have 25x your annual expenses saved. Personal Finance author Nick Maggiulli found a 100% probability, historically (1926 to 2022), that a 4% withdrawal rate was sustainable in retirement.

Financial Planning writer and podcaster Michael Kitces further extended the study to show that investors following this rule were historically more likely to quadruple their money than run out. Given that only 18% of retirees actually increase their spending in retirement, this rule of thumb should give retirees who meet the threshold a lot of confidence.

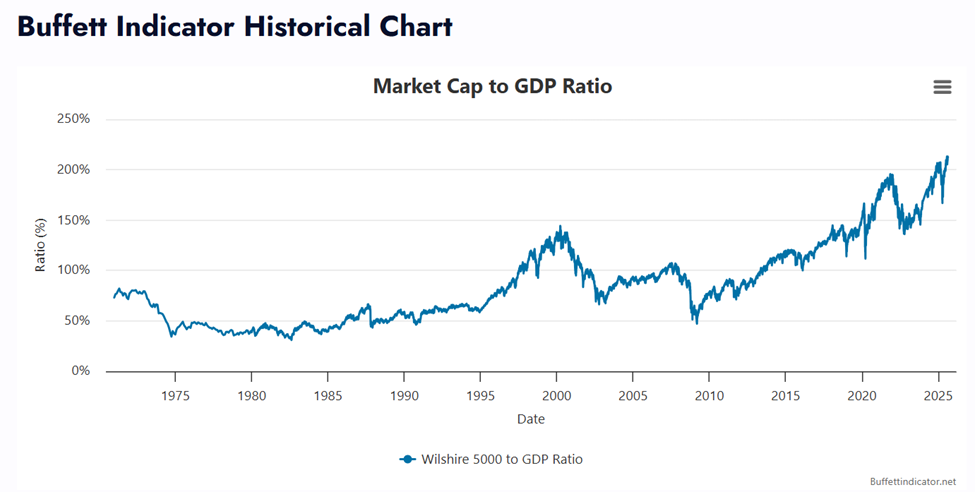

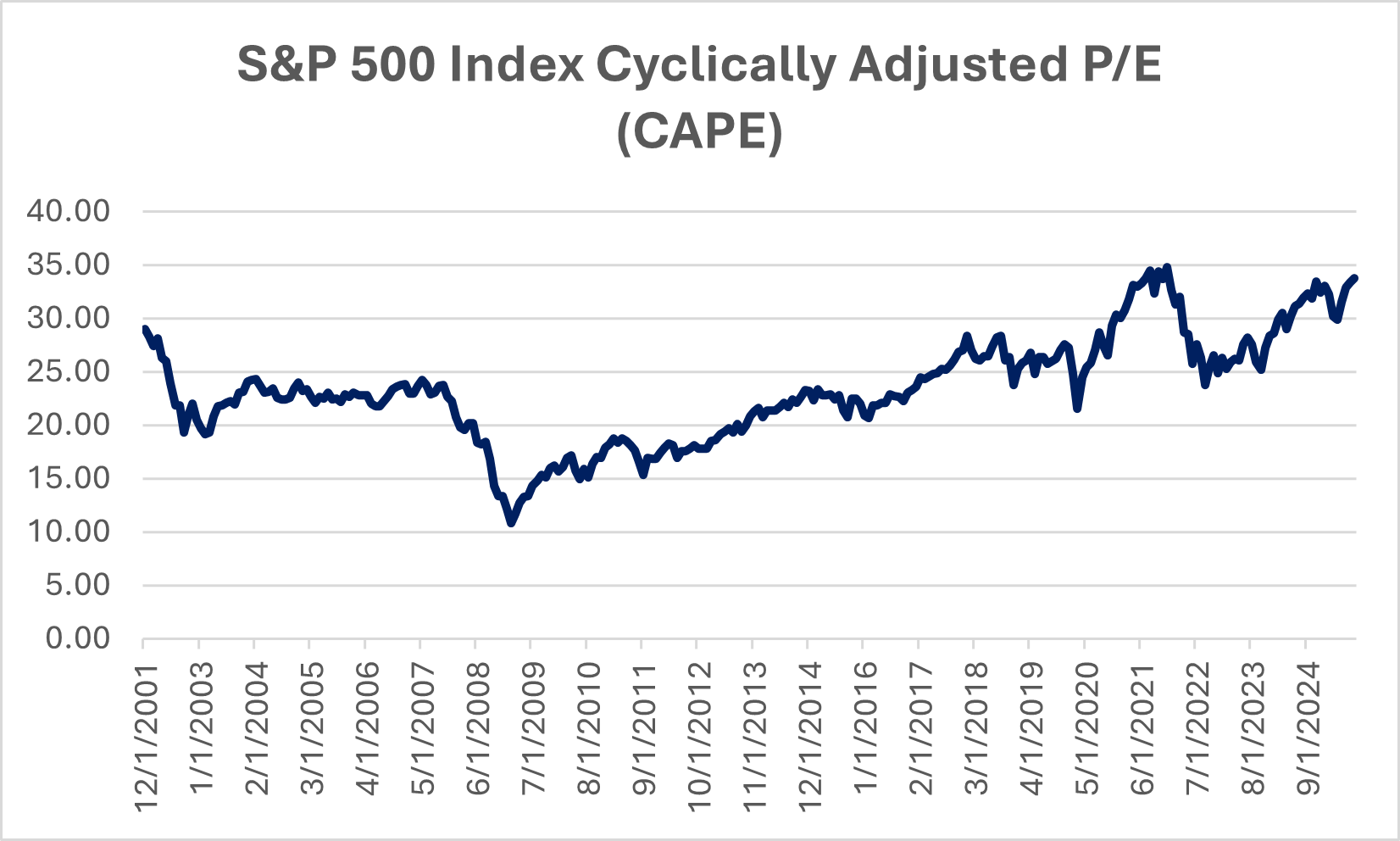

Not every 30 year period is created equally, of course. And, how an individual invests can increase or reduce their comfort in retirement. What is a good comparable time period for investors and prospective retirees today? Helpfully, where we started nearly a quarter century ago strongly resembles today’s markets. The S&P 500’s CAPE valuation is nearly identical.

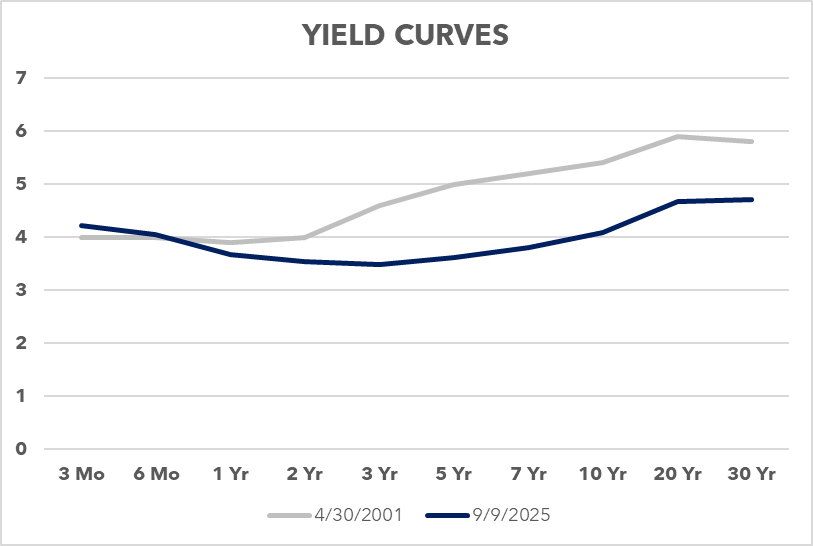

The front end of the yield curve is nearly identical and the back end only slightly different.

Even the excitement over a new technology is the same. Only then it was the commercialization of the internet. Today, of course, it is AI.

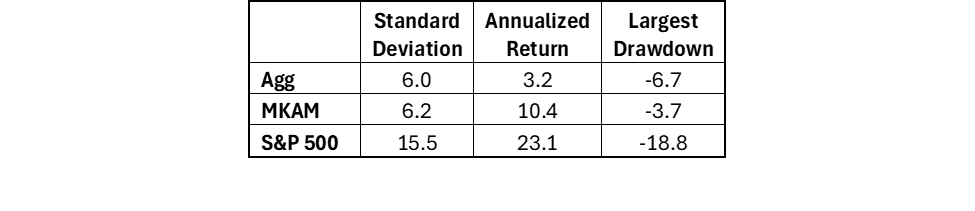

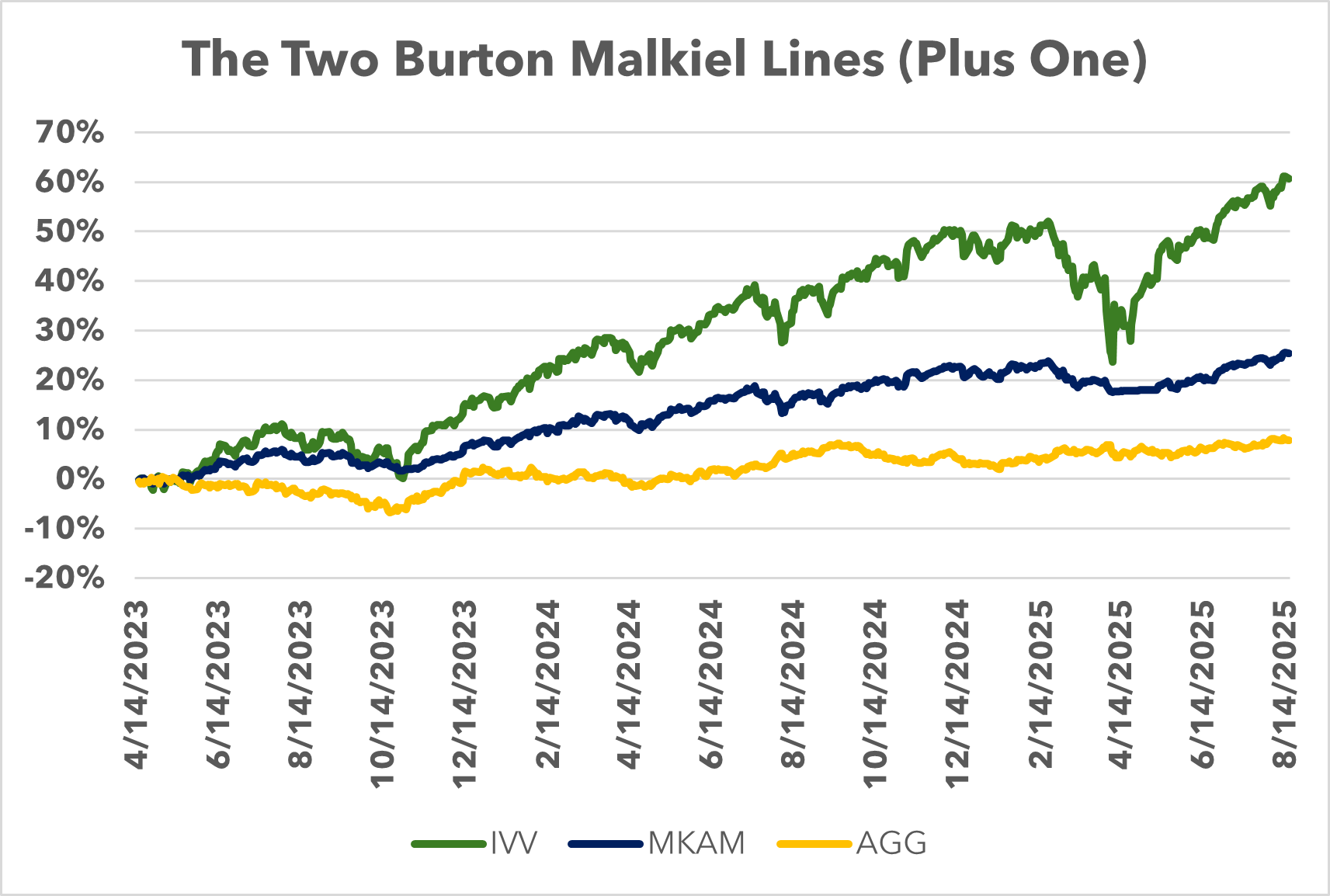

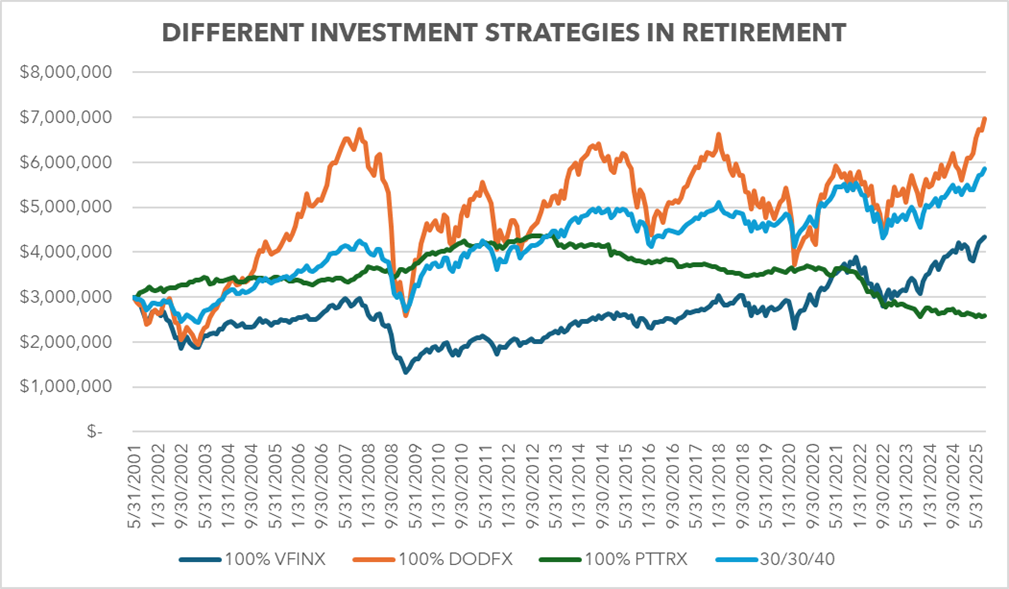

Running the 4% withdrawal rule through the specific time period from 2001 through August of 2025, utilizing different investment strategies, was elucidating.

Each investor in our study retires on April 30, 2001 with a $3,000,000 portfolio. For simplicity, we assume the money is invested in tax-deferred accounts so that we can ignore them. One investor invests 100% in the S&P 500 (VFINX). Another invested 100% in international developed stocks (DODFX). A third, the most conversative, invested in 100% bonds (PTTRX). Finally, our balanced investors, placed their money 30% in the S&P 500, 30% in international stocks, and 40% in bonds. How did they all do?

One of the first things that jumps out from the graph is how off to the races the international stocks investor began. Investors today are quite used to the S&P 500 crushing the rest of the world’s stock market.

But, from 2022 to 2007 international developed stocks crushed the S&P 500. For those six calendar years, the S&P 500 grew 6% a year or 42% cumulatively. While, DODFX rose 19% a year or 187% cumulatively. One of the reasons for the international outperformance is that the US Dollar declined by 37% during that same time frame.

Additionally, you can see that our bond (PTTRX) investor was doing quite well from 2001 until 2013. Ideally, retirees could invest in safe bonds, exceed a 4% rate of return, and never have to worry about running out of money or returning to work. But, after the Great Financial Crisis, the Federal Reserve led by Chairman Ben Bernanke brought rates down to 0%, and left them there longer than anybody thought reasonable or possible, eventually significantly hurting our bond only investor.

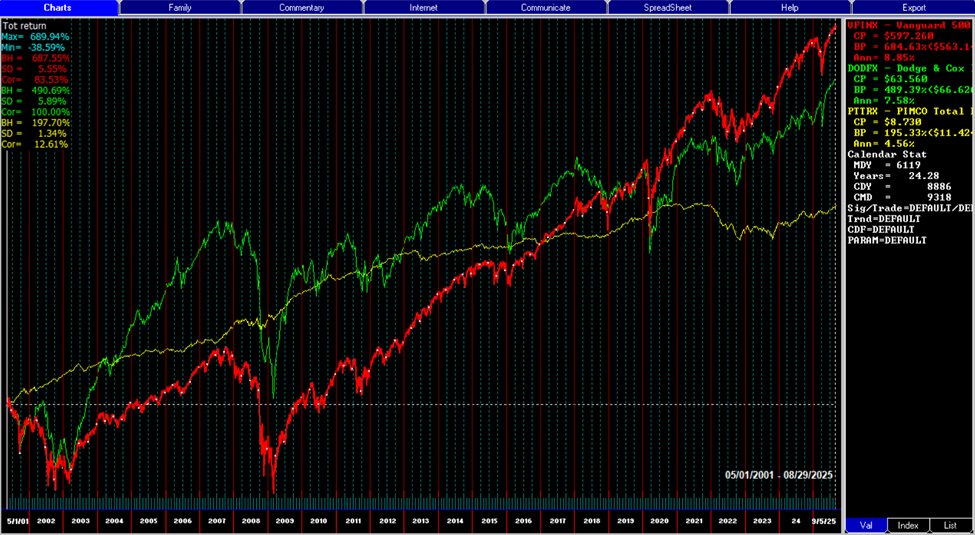

The S&P 500 (VFINX) investor experience neatly illustrates the idea of “sequence risk.” Below, you can see the annualized returns. Notably, the S&P 500 has the highest return in the chart.

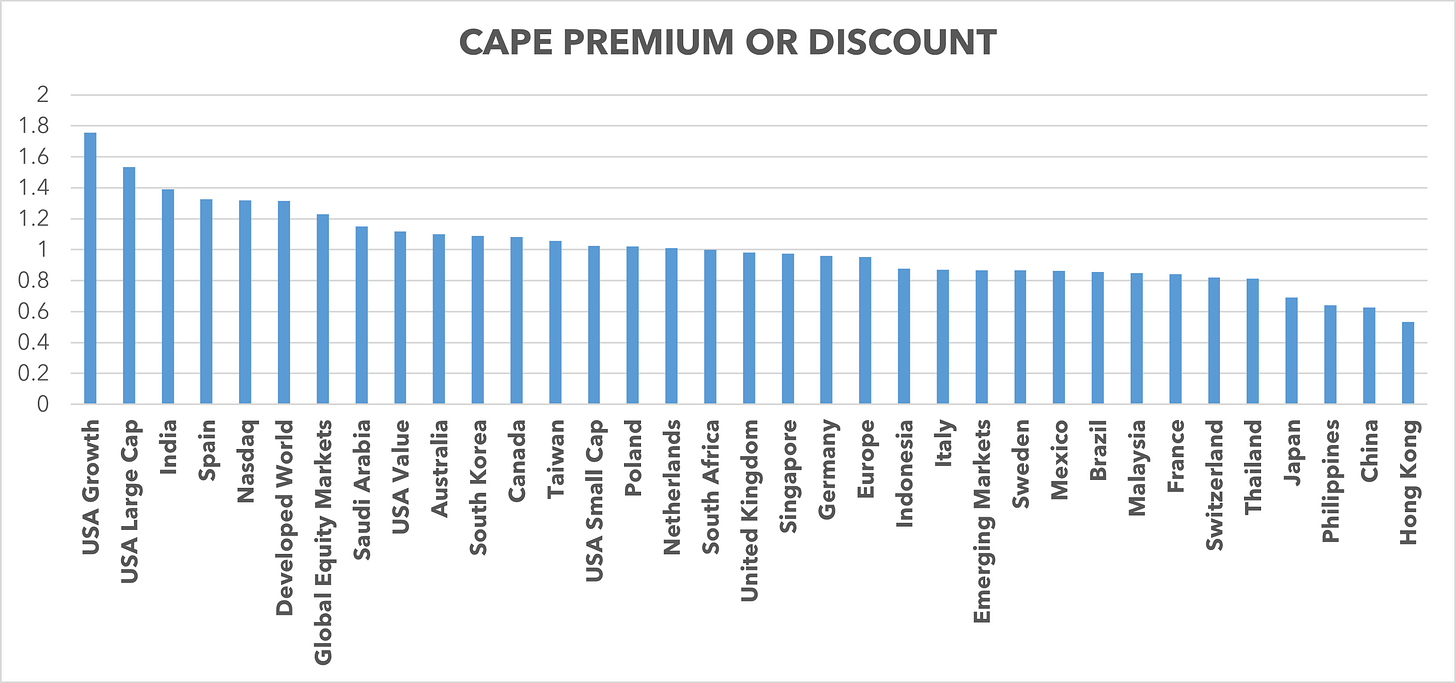

However, our S&P 500 investor above ended up with the same portfolio size as our bond investor. Despite earning materially higher returns. How? When your returns occur really matters. Remember, our retiree has to meet their expenses regardless of what the market does. Taking fixed withdrawals from a decimated portfolio in 2001 and 2008 meant the investor required amazing returns just to get back to even. While the S&P 500 earned the highest return over the full 25 years, this investor only finished in third place where it counted, in terms of portfolio size. This is important to ponder as the S&P 500’s valuation today is the same as it was in 2001 and 2007. Will the market crash like then? Who knows, we’re not forecasting an imminent one. However, while valuations are extreme, the risk remains elevated that one may occur.

Finally, our diversified investor finished in a very respectable position. While never dipping far below par, our diversified investor finished with about double the portfolio they started with. And that’s with riding through the storms of 2001, 2008, and Covid. Not bad.

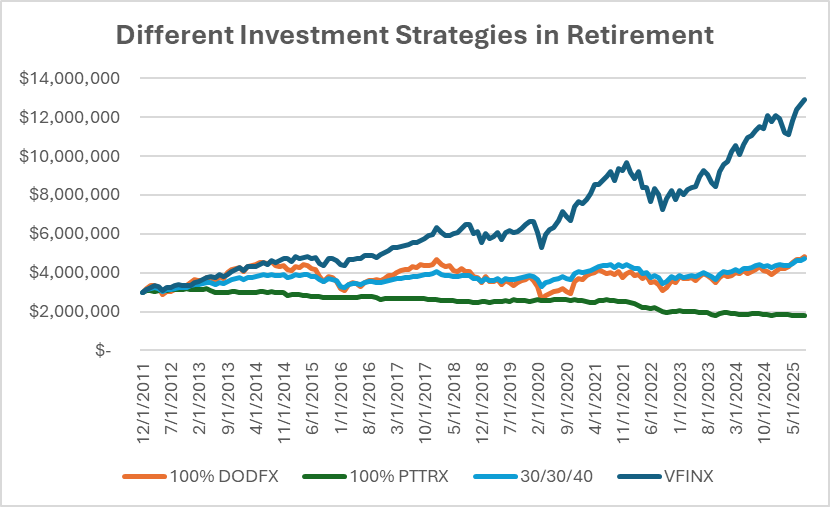

Of course, if we took the period from 2012, stripping out the DotCom crash and the Great Financial Crisis, the S&P 500 only investor completely dominated:

Implicitly, many investors today are primed to believe this experience is representative of the future. Afterall, who wouldn’t want to see their portfolio grow from $3-million to $13-million while making regular and substantial withdrawals. That's a very pleasant and reinforcing experience. However, the 2011 to 2025 results are very unlikely to repeat.

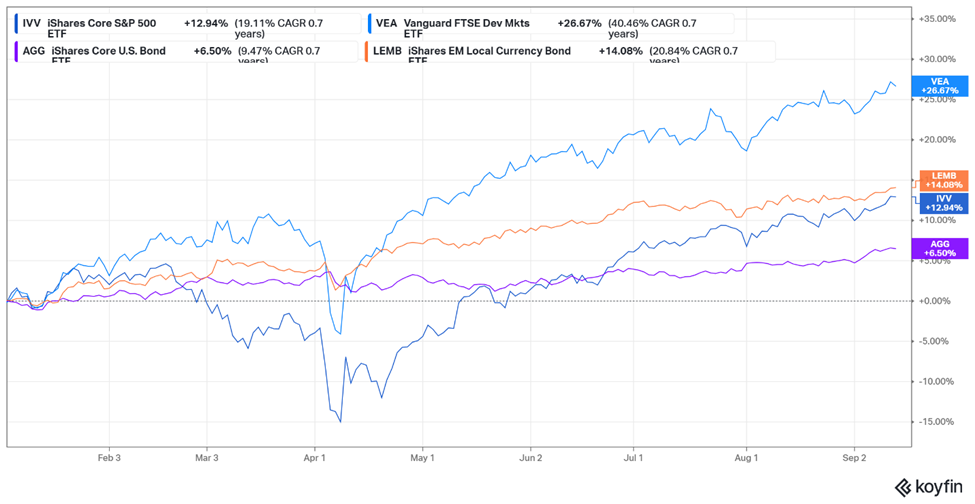

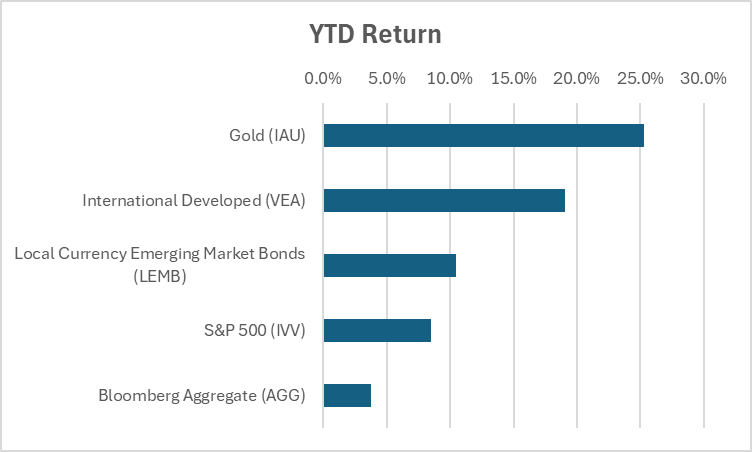

Is a period like the start of 2001 possible? Where investors in international stocks strongly outperform those exclusively featuring stocks in the USA. Here are year-to-date returns for 2025 through today’s close. After falling -15% the S&P 500 rallied back strongly to be up 12%. International stocks barely dipped below par and are now up 27% year-to-date. Déjà vu? Even local currency emerging market bonds are outperforming the S&P 500 with a lot less volatility and downside risk.

The 4% withdrawal rule remains timeless wisdom. How best to invest your hard earned portfolio evolves with the underlying market conditions, economics, and politics. Investors today would be wise to look at historical periods before 2011 to 2024 to gleam the right lessons.