The latest Vanguard Capital Markets Model Forecast has an expected return for the S&P 500 over the next decade of 4%. They also forecast an Aggregate bond return of 4.5%. It may seem preposterous that the bond expected return would be higher than the S&P 500. But, this was precisely the case in 1999. And it came to fruition: bonds beat stocks from 1999 through 2017. The late 1990’s was nothing like today, however. The pre Y2K era was characterized by investor euphoria over a new technology that was going to transform the world. Investors were willing to pay any price for any company having to do with AI, I mean the internet. Again, nothing like today.

So, forecasting the classic 60/40 investment approach - 60% S&P 500, 40% Bloomberg Aggregate Bond Index- that so many advisors consciously or unconsciously use, an investor can pencil in returns of: 4.2% per year for the next 10 years. In other words, not great. 10-Year US Treasuries offer 4.2% today. An investor with a 10-year horizon could buy a T-bond, ignore the markets, experience no risk to their outcome and match an uncertain and volatile 60/40 portfolio.

Or, investors can start to deviate from the 60/40 benchmark. One change that should prove accretive, after about 15 years of detracting value, is swapping some of the S&P 500 into international stocks. Vanguard’s same model forecasts 6.7% for international stocks. Two things about international stocks are true:

- International companies, generally, are less dynamic and grow slower than their US peers

- International stocks are priced at or below average, while US stocks are near peak over-valuation

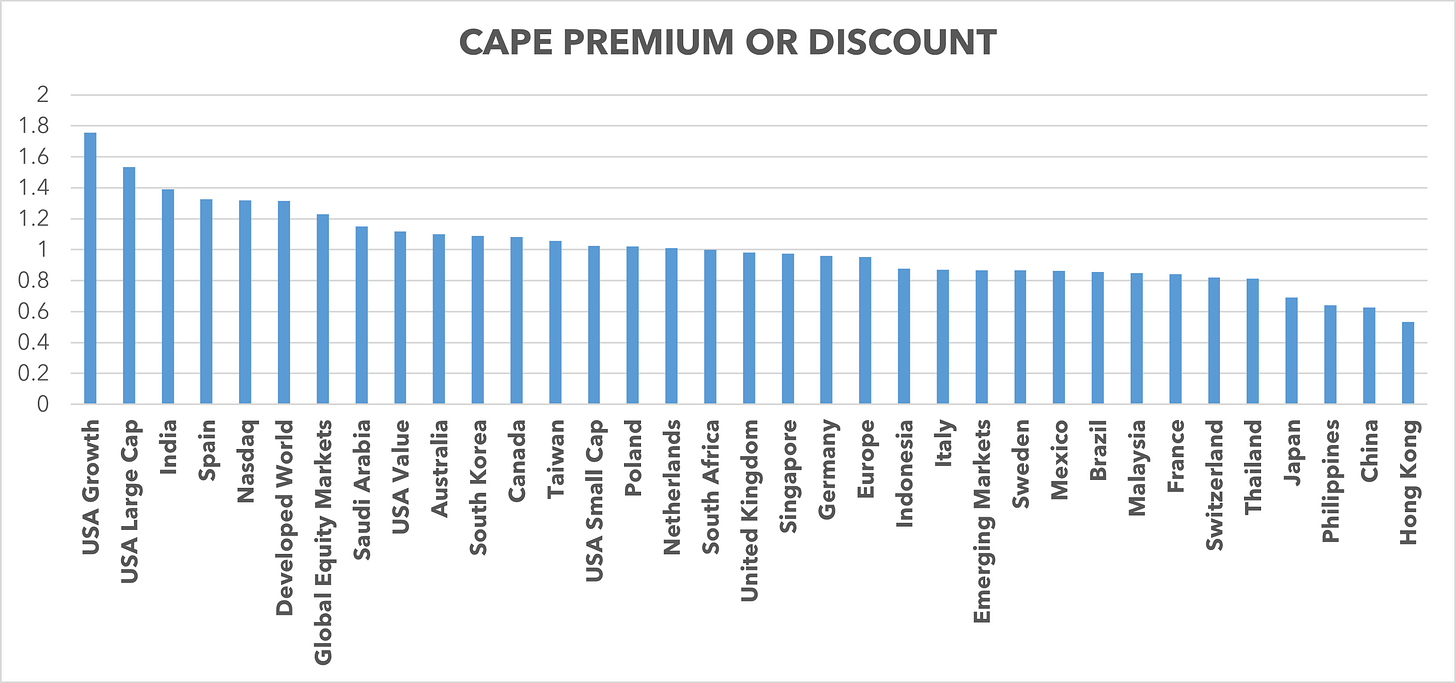

The discount for international stocks is well above what is warranted by the (not as big as you may think) gap in growth they historically experience relative to their American peers. The graph below compares stock markets around the world by dividing their current CAPE, courtesy of Siblis Research, relative to their averages since 1980 (or shorter, if data not available). A market priced at 1 is exactly in line with their average; for example, Holland and Poland. Markets below 1 trade for a discount; such as, Sweden, France, Switzerland, etc. Growth stocks in the USA trade for the highest premium at 1.8.

Source: Siblis Research and MKAM

One final note about the compelling opportunity in international stocks. Models like Vanguard tend to assume away changes in exchange rates. They are hard to forecast and over the very long run, currencies tend to rise and fall and cancel out. However, currencies often move in prolonged trends. The US Dollar rose from 2011 through 2024. In 2025 it has been falling. If the US Dollar continues to weaken, and there is a very good argument to be made that it will, the actual investor return for Americans investing abroad should prove higher than Vanguard’s expected returns.