Professor Burton Malkiel recently wrote an excellent op-ed in the New York Times that contained good analysis and sound, if incomplete, advice.

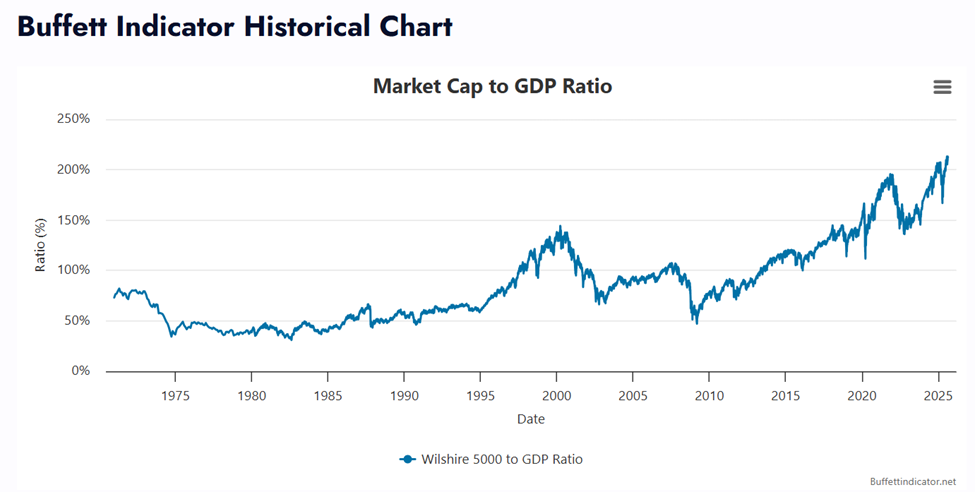

First, he established that the stock market was worryingly expensive. He wrote: “Stock markets regularly go to irrational extremes, and their volatility has caused economic hardship and financial pain. Now, jubilant investors are pushing our market to historic highs.” Consider the “Warren Buffett Indicator,” which compares the USA’s total stock market capitalization to GDP, shown below, which recently reached an all-time high:

Next, Mr. Malkiel compares today’s stock market multiples to the previous Dotcom and housing bubbles. He then understandably asks: “if history is repeating itself, what can we do to protect our financial futures?” He answers:

• “If you are retired, and need money soon, you should invest it in safe short-term bonds.”

• “For young investors just starting to build a retirement fund, a portfolio heavily weighted with stocks is appropriate.”

While this advice is broadly correct and helpful, it also leaves a lot of room for improvement. What about the people that are nearing retirement, but not quite there? Or the younger savers who just started to have a large enough portfolio to worry about? What do these people in the in between stages do. Also, for the retirees, is all-in bonds really the best they can do?

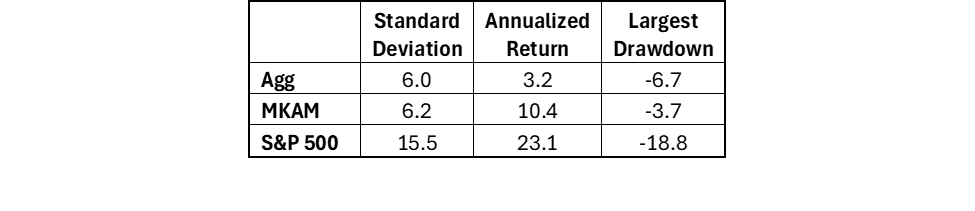

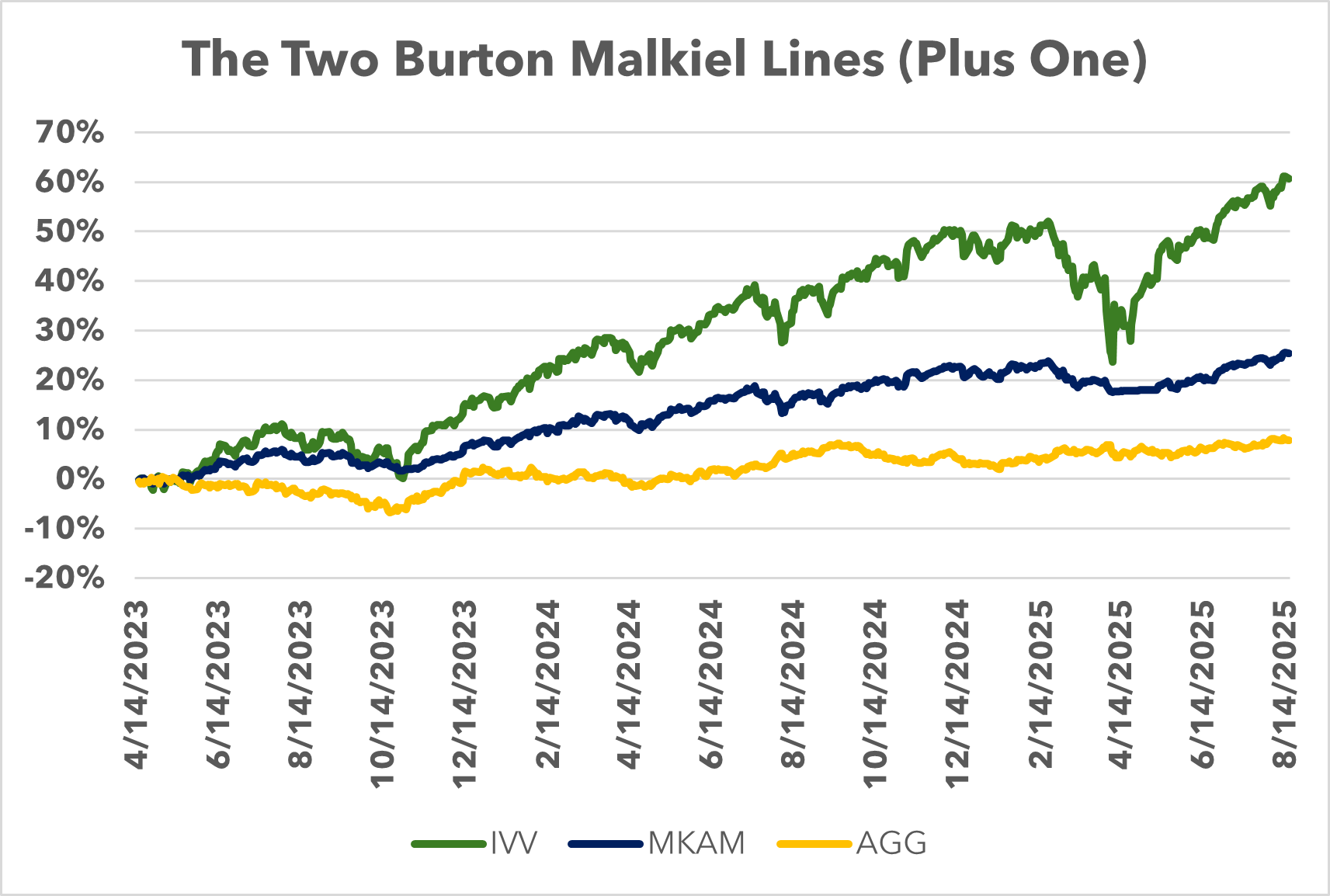

Since April of 2023, investors who shunned the stock market due to concerns about valuations, tariffs, or other valid concerns would have earned 3.2% annualized returns in the Bloomberg Aggregate bond index. Their standard deviation would have been 6% and their largest drawdown was -6.7%.

Alternatively, that same investor could have invested in the S&P 500 using a discipline of trend following and valuation, shown as “MKAM” below and returned 10% per year with a bond-like 6.2% standard deviation and a lower than bonds largest drawdown of only -3.7%.

Historically, investors only had the option of investing in the two choices Professor Malkiel laid out. For compliance reasons, I cannot tell you how to access the blue line in a very liquid, low cost way. However, astute readers can connect the dots quite easily. Perhaps you can ask ChatGPT for guidance. We tested it out and agreed with their first suggestion.

Burton Malkiel is right to note that today’s stock market is “getting scary.” However, using a discipline of trend following and valuation can remove the fear while, we believe, generating better than bond returns.