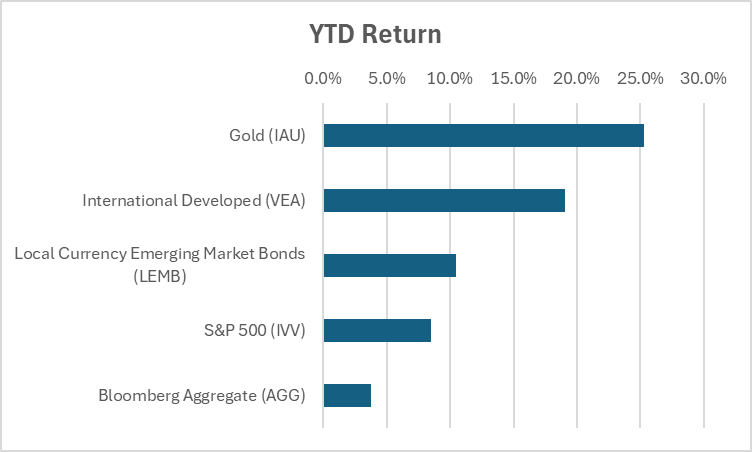

Year-to-date through July, a traditional 60/40 portfolio, 60% in the S&P 500, and 40% in the Bloomberg Aggregate, would have returned 6.6%. Completely respectable for 7 months of the year.

However, returns could have been improved to 11.2% if half of the 60% was carved out from the S&P 500 and allocated to international developed stocks; another 5% to local currency emerging market bonds; and 5% to gold.

Since the S&P 500 bottomed at 666 in 2009, owning the S&P 500 was all investors needed. Foreign investors received even better returns for owning American stocks as the US Dollar relentlessly appreciated as well. But, at the start of 2025 it was our contention that the tides were changing. We believe 2025 is not a temporary aberration but augurs a different decade to come. We will detail it as it unfolds here.